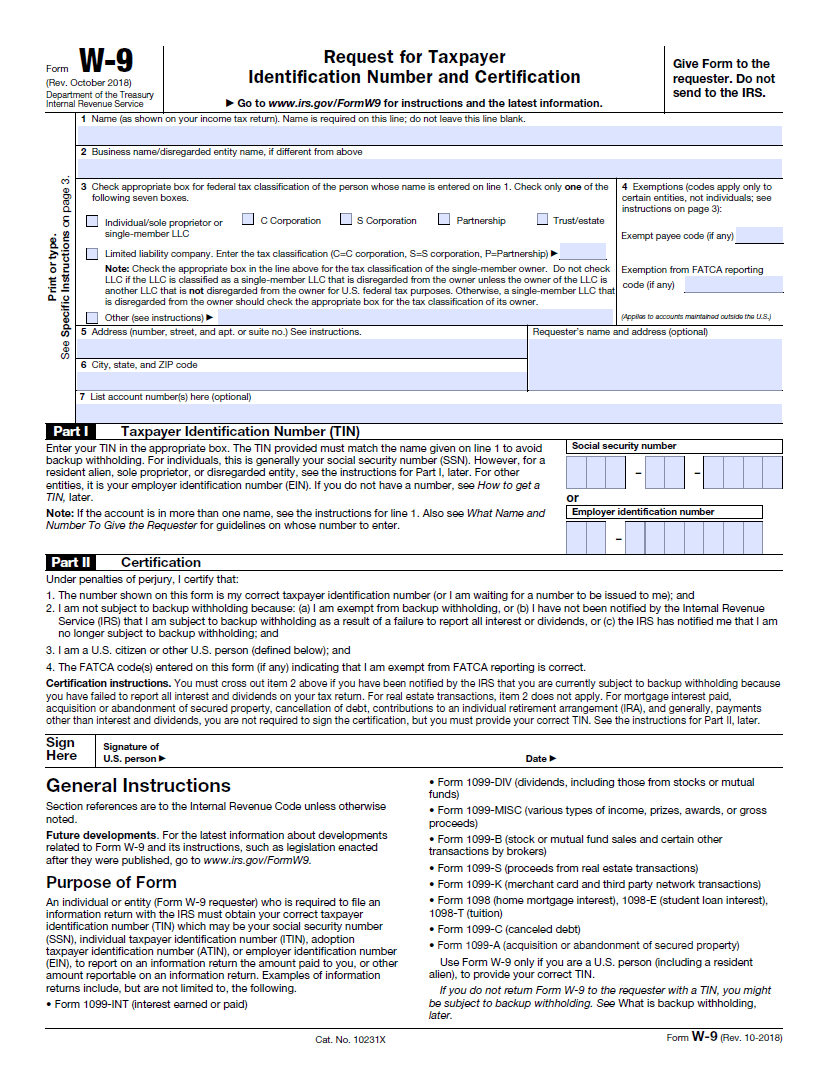

We discuss when to issue Form 1099Misc to Your Independent ContractorsPlease subscribe to the channel and leave a comment below!Related to dietland review free printable 1099 nec form wwwpdffillercom IRS 1099NEC eFile Form Print or Fill Out Now Register Access IRS Tax Forms Complete, Edit or Print Tax Forms Instantly Get Ready for Tax Season Deadlines by Completing Any Required Tax FormsForm 1099 is used for payments to independent contractors made during the year Form 1099MISC is also used for payments to attorneys, doctors, veterinarians and other professionals for services performed by them Form 1099 MISC is not a substitute for Form W2 You will still need to file a Form W2 to report your wages and taxes to your employer

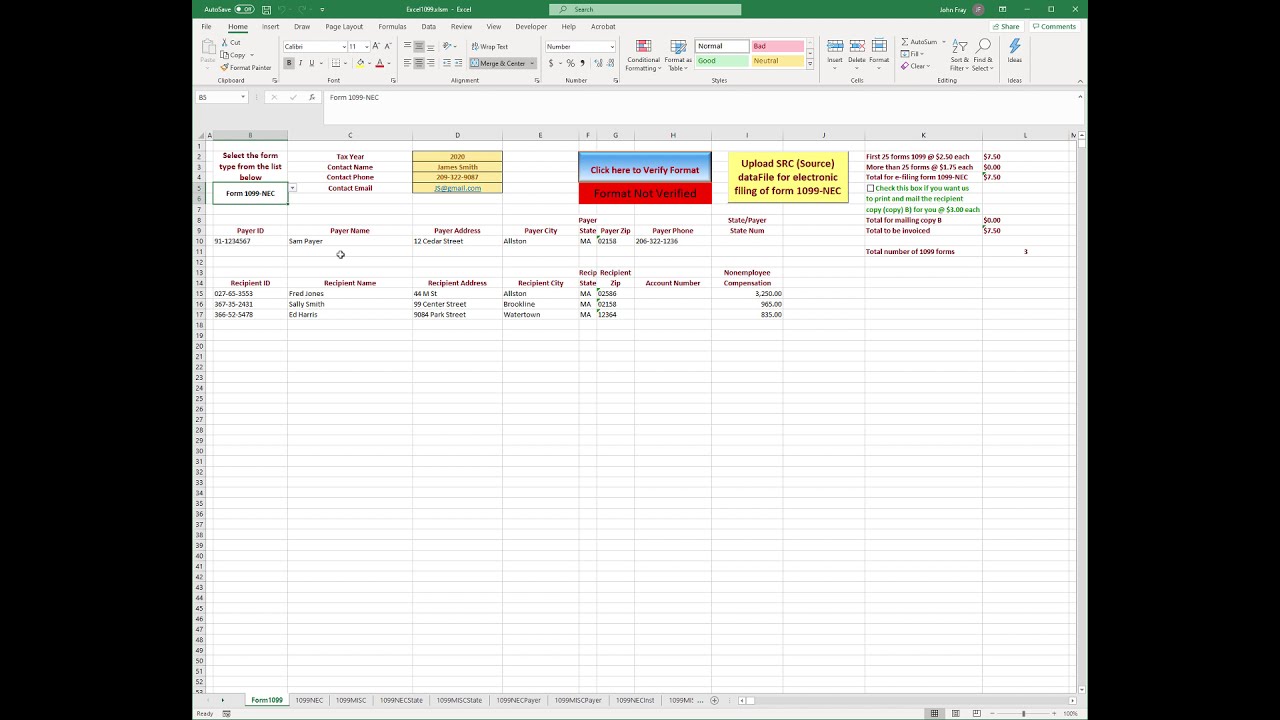

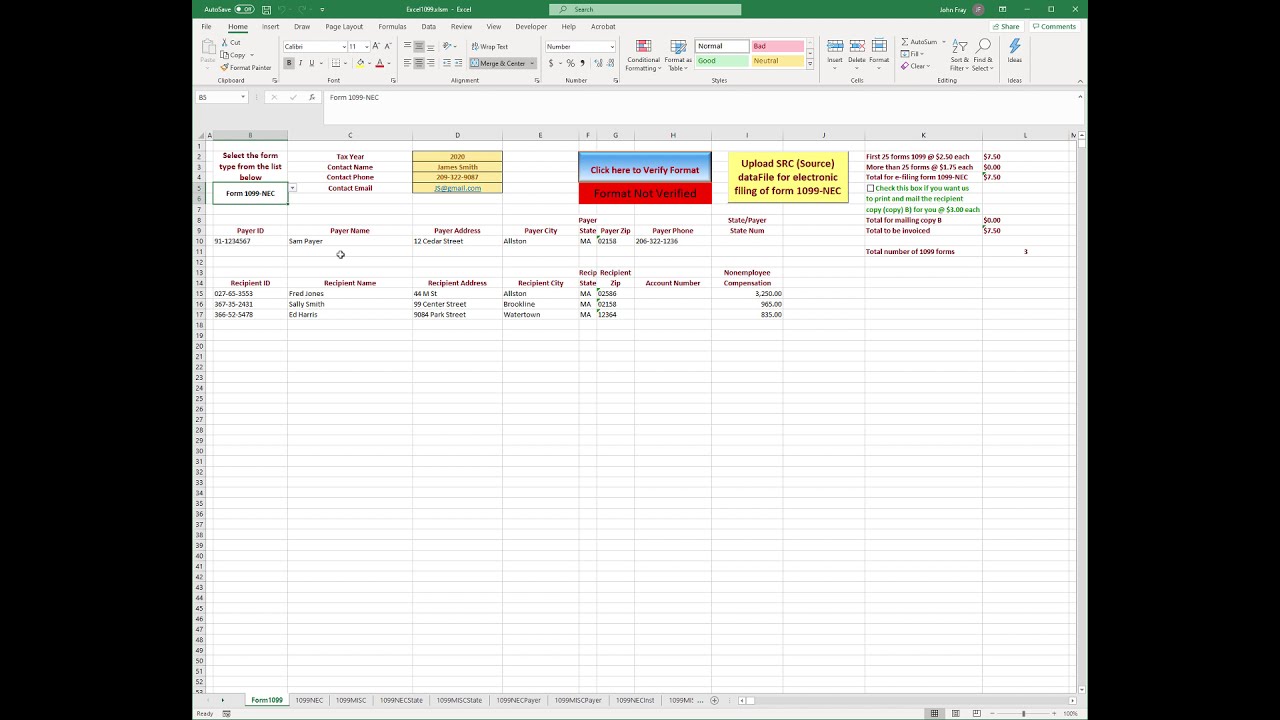

Excel1099 How To File Form 1099 Nec With Excel Youtube

Independent contractor printable 1099 form 2020

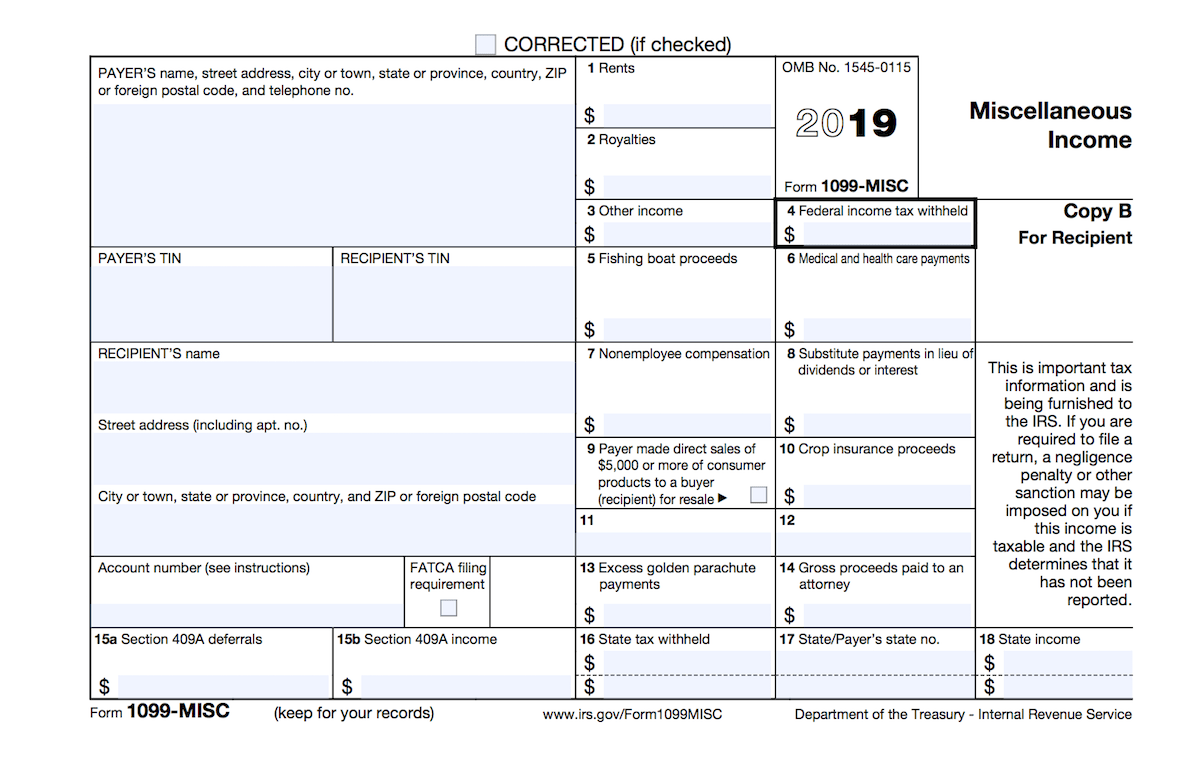

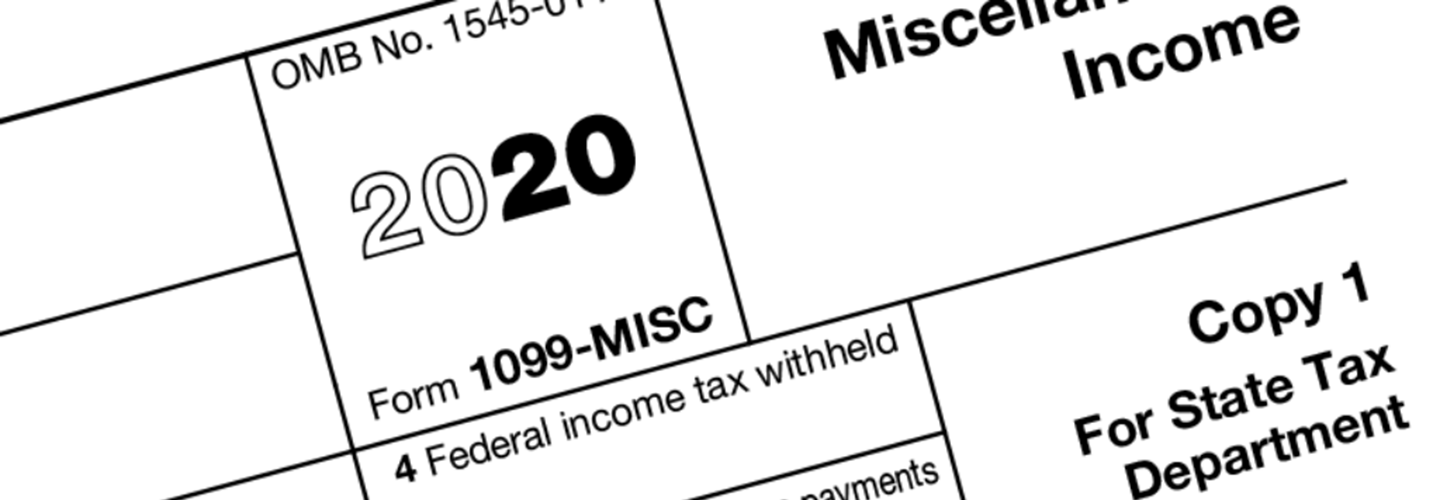

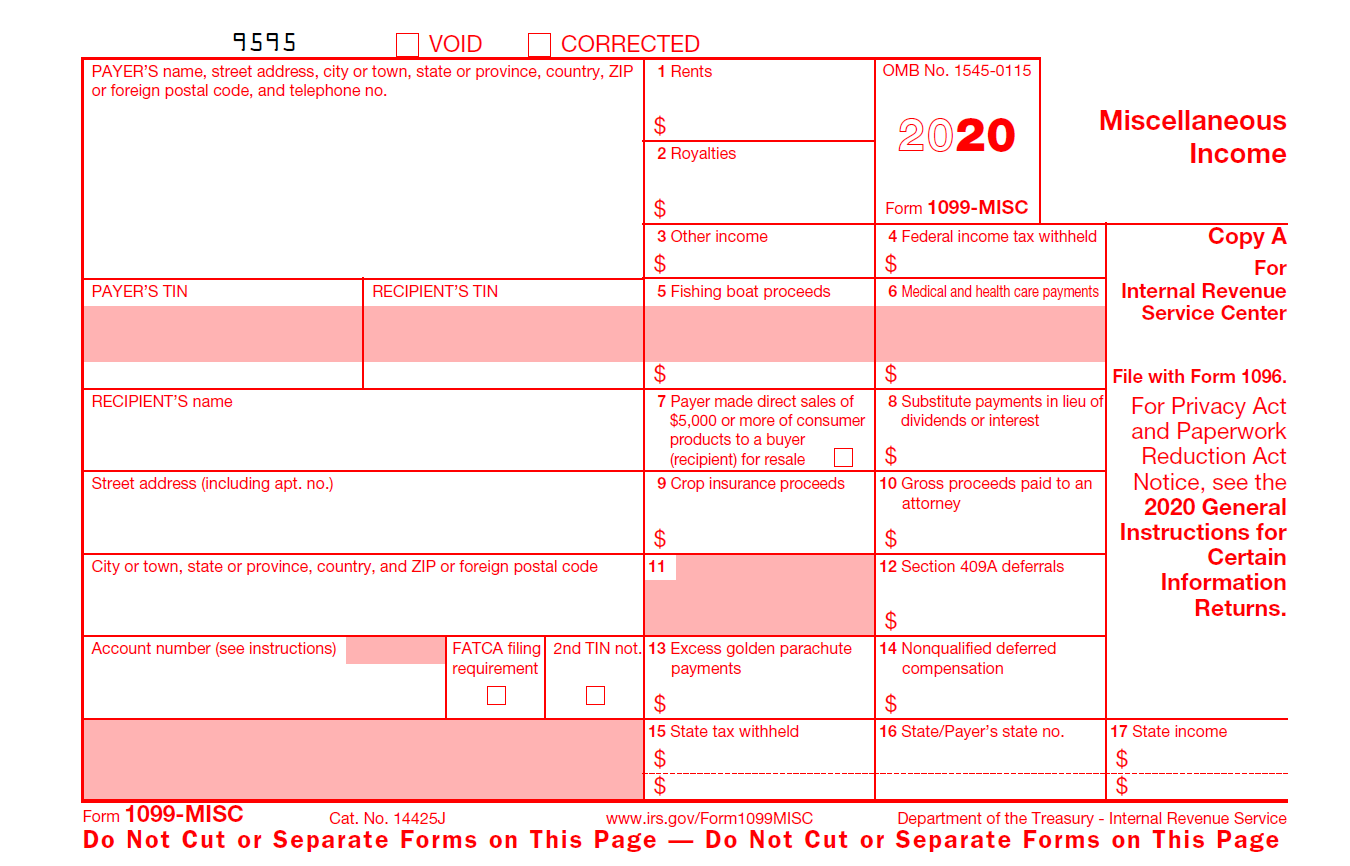

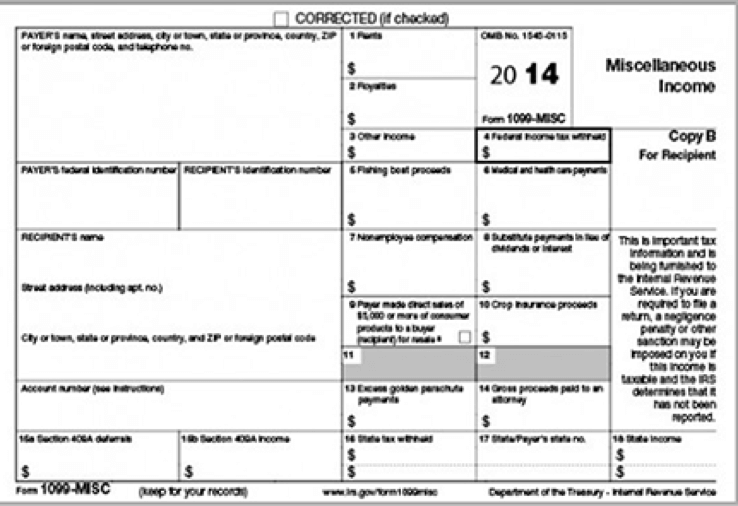

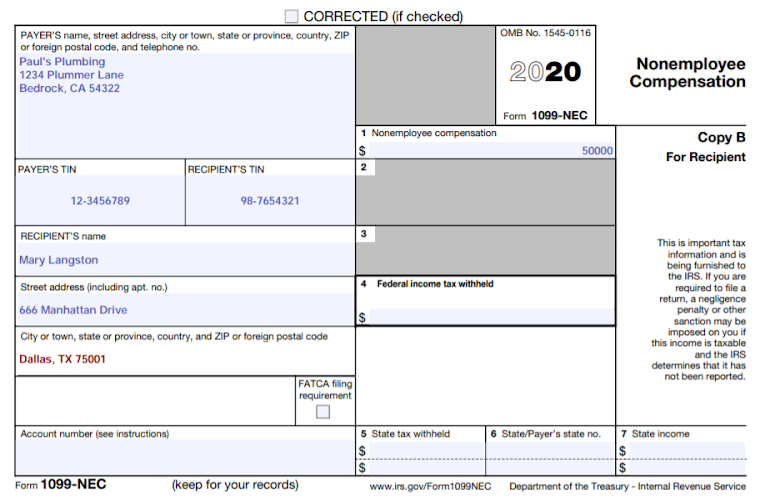

Independent contractor printable 1099 form 2020- Independent contractors IRS 1099 Form is issued to an independent contractor who performed work on a course of business or trade and receives income annually For example If the payee receives an independent contractor income of $600 as machine rent, then the payee receives a 1099 MISC Form 1099 MISC Form is issued to the recipients who receiveA 1099 MISC Form Online is a tax form used for independent contractors or freelancers A 1099 MISC Form Online is a tax form used for independent contractors or freelancers

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

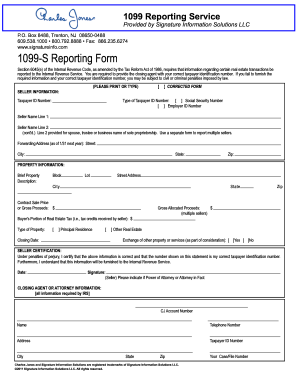

When a person is hired for a new job, the employer should fill out a 1099A form The 1099A form is used to report payments made to an independent contractor or other person The form is not necessary when the employer has their own tax identification number Form 1099A is a form issued by a bank or other financial institution to a person who has made a deposit or by Clarimunda Fortier 21 Posts Related to Printable 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors Tax 1099 Forms For Independent Contractors Printable Independent Contractor 1099 Form 1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free InstructionsIf you are an independent contractor for a business, you may wonder what the 1099 rules are for employers where contractors are concerned

In common words a 1099 Form reports all income earnings, dividends, payments, and other personal income The most popular type is a 1099 Misc Form On this website, users can find What is 1099 Form Printable versions for 1099 Form for the year in PDF, DOC, JPG, and other popular file formatsForm 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kindsIf you're a US Legal Forms subscriber, just log in to your account and click on the Download button After that, the form may be found in the My Forms tab Visitors who don't have a subscription should complete easy actions before having the ability to get access to their SelfEmployed Independent Contractor Agreement with Health Care Worker

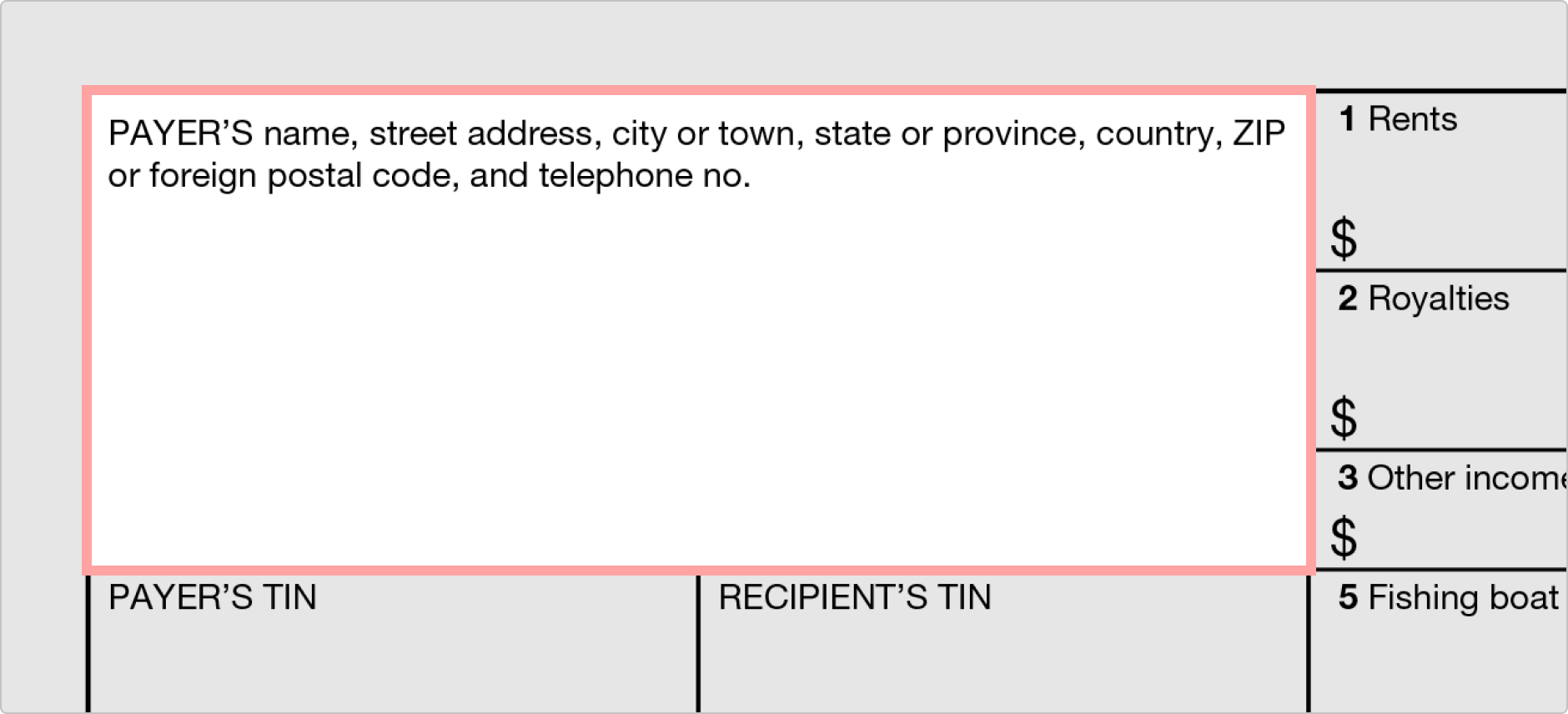

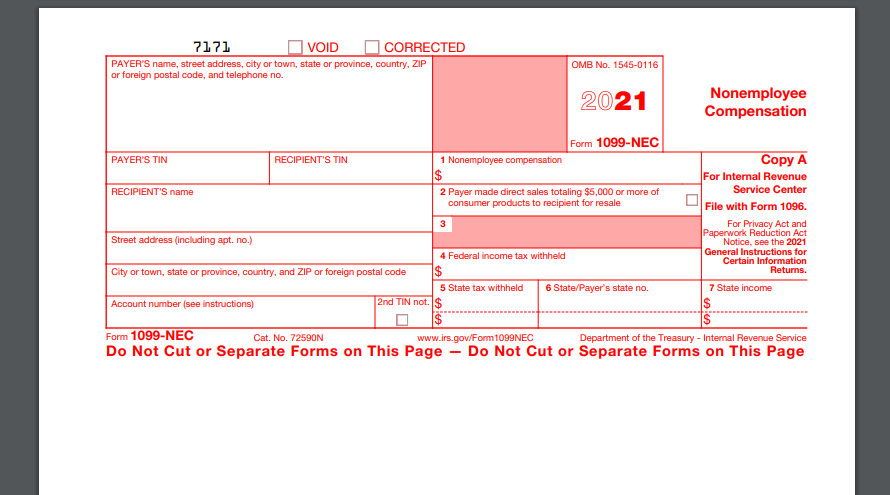

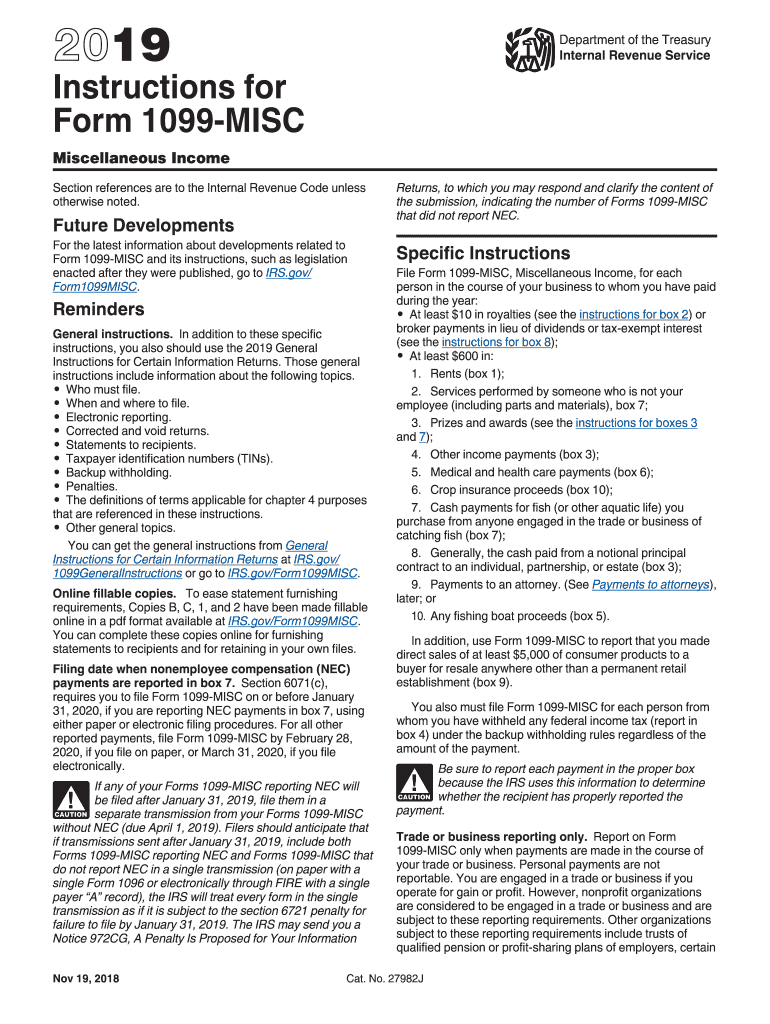

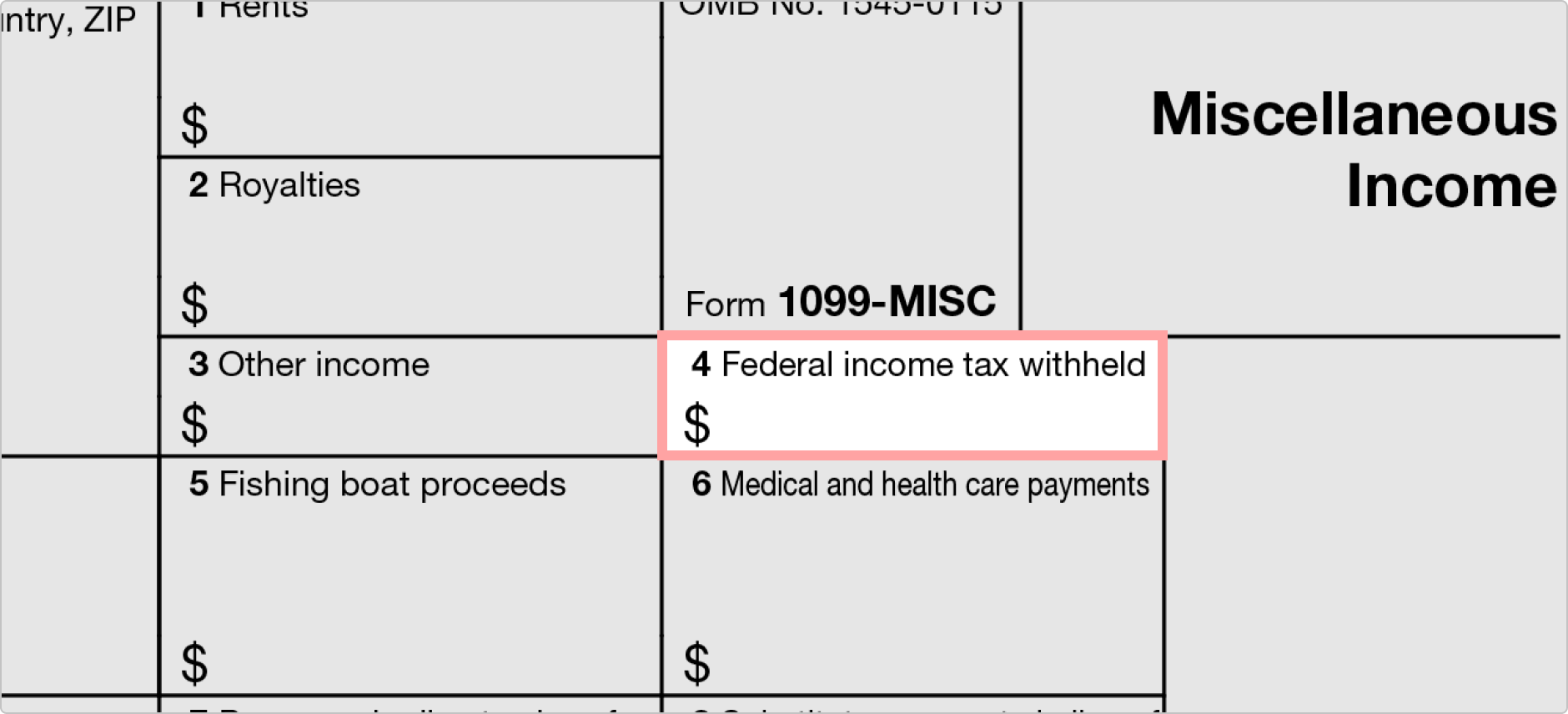

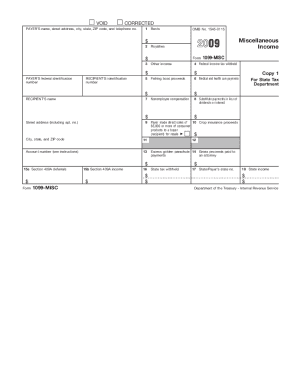

1099MISC Form Starting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured below A 1099NEC Form is now the appropriate form to 1099 Form Independent Contractor Pdf / W 9 Form Fillable Printable Download Free Instructions Here's everything you need to know about the process The 21 1099 form is used to report business payments or direct salesPrintable 1099 Form Independent Contractor TUTORE ORG Print this templates There are many types of 1099 forms since there are many ways to earn nonemployment income As an example, for the tax year freelancers and freelancers who earned $600 or more in nonemployment income will be issued the 1099NEC 1

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

Fillabletaxforms

Follow these steps to properly prepare for completing your printable 1099 tax form 19 Collect the required information about each independent contractor you hired during the last year Access your 1099 tax forms printable at our website Print the templates out or fill the forms online without having to do it manuallyA list of job recommendations for the search 1099 form for independent contractor is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested 1099 Form Independent Contractor Pdf / Printable IRS Form 1099MISC for 15 (For Taxes To Be These can include deducting costs for your home office, vehicle expenses, advertising, continuing education, insurance pr

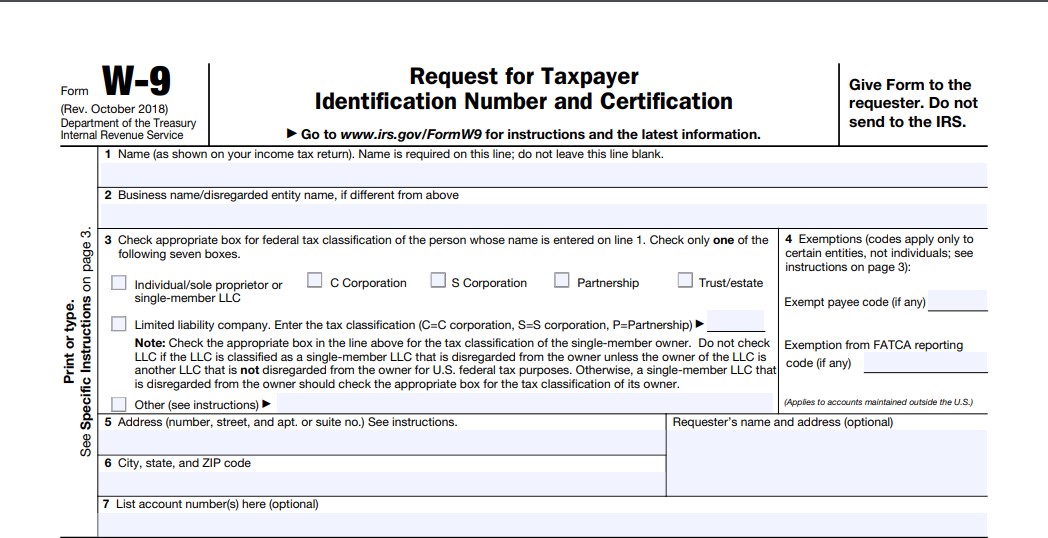

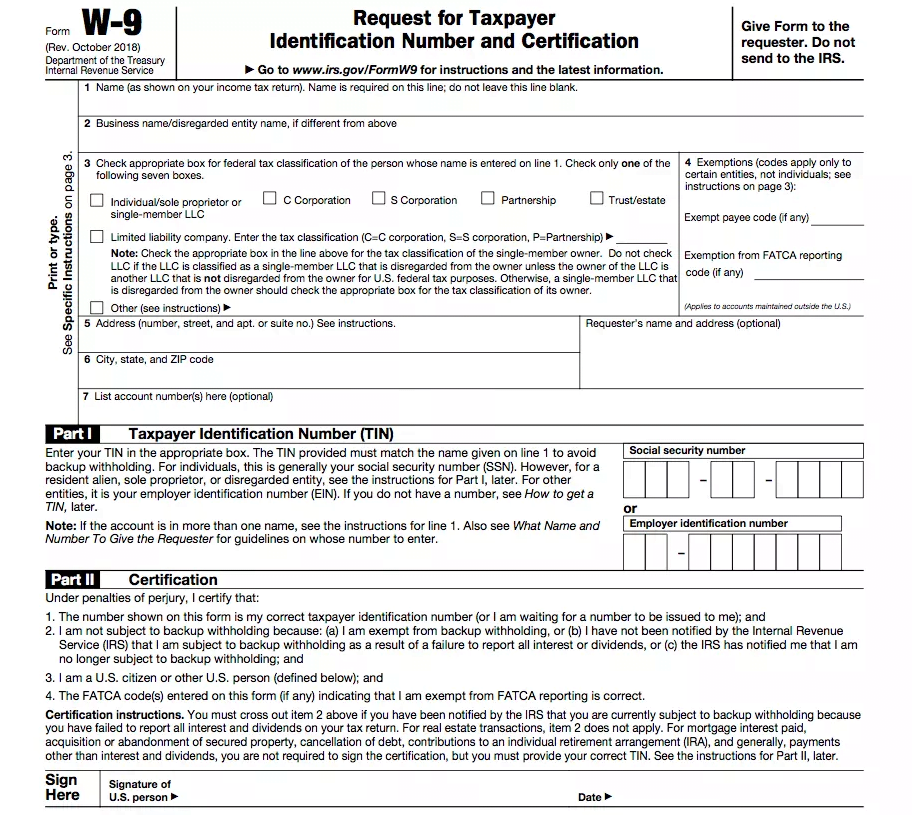

W9 Form 21 Printable Fillable

Filling Irs Form W 9 Editable Printable Blank Fill Out Or Print Irs Blank For Free

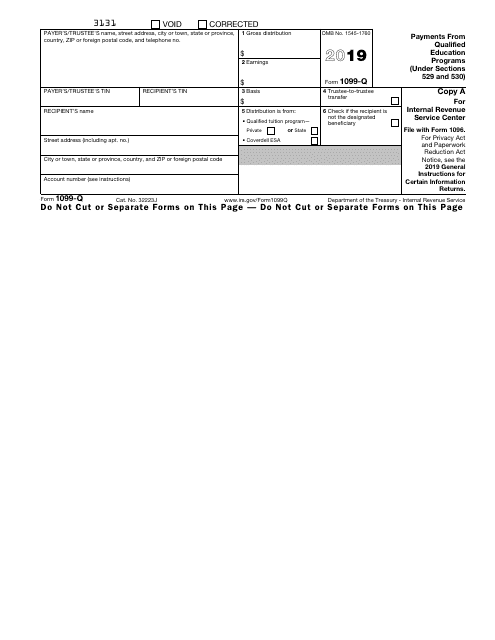

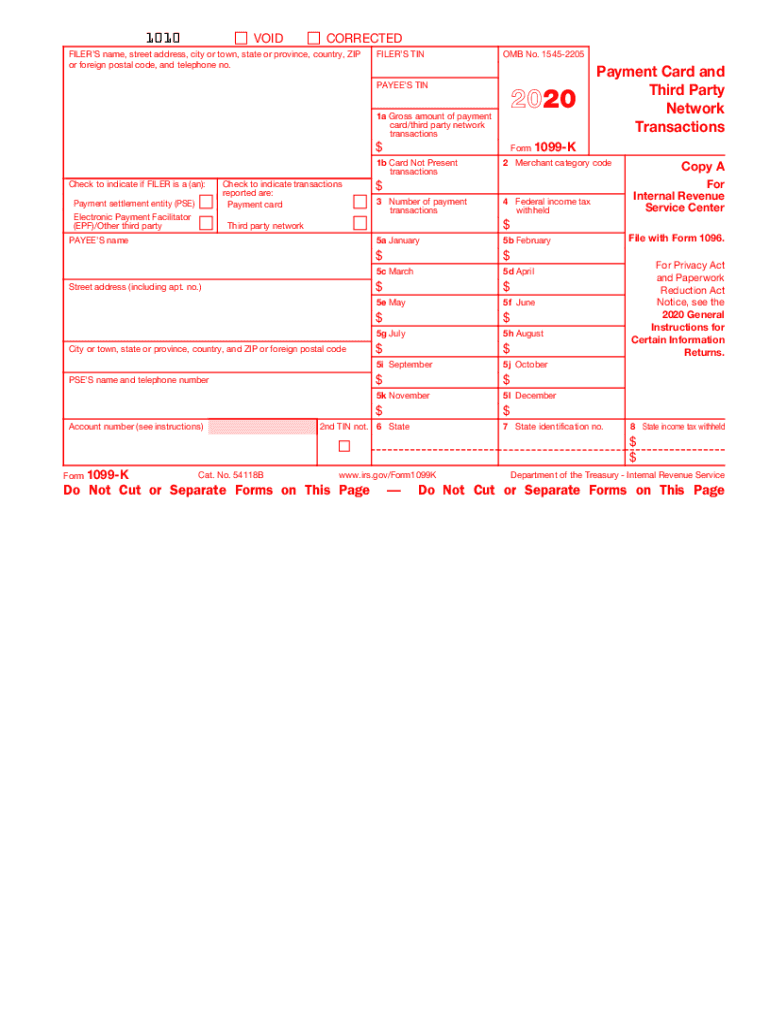

You may also have a filing requirement1099 Form Independent Contractor Pdf You must also complete form 19 and attach it to your return Fill out, sign and edit your papers in a few clicks 1099 k for If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes There is a lot of confusion regarding independent contractors The primary tax form File 1099 Online form for 21 with IRS Approved 1099 EFile service provider, to report 1099 NEC,1099 Misc,1099 Div,1099 Int,1099 A,1099 K & 1099 R Call A 1099R form is one of the forms in 1099 These 1099 Tax Forms are used to report several types of income that a person may get, other than salaries, such as independent contractor income

What Is A 1099 Form And Do I Need To File One River Iron

1099 Misc Form Fillable Printable Download Free Instructions

FREE (wForms) one hey guys this is hafiz today we're going to talk about uh the 1099 how can we issue the 1099 to the honor operators or the drivers uh As uh they are not the the employees of the company so, we can uhPrintable 1099 Form Independent Contractor – One of the most significant and basic paperwork you have to have all the time is a 1099 form It's a form the IRS requires all companies to maintain It can be used by businesses as an efficient way How to issue 1099 to Independent contractors/truck drivers/owner operators?

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

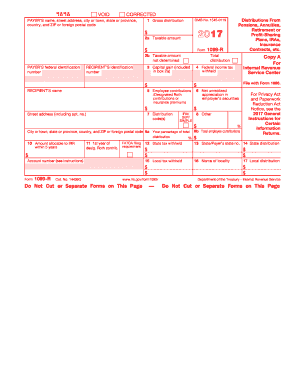

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,√100以上 independent contractor 1099 form Which 1099 for independent contractor Here, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application processIndependent Contractor 1099 MISC Form In the tax year , we can observe most of the workers choosing to become a 1099 worker Independent contractor The independent contractors are 1099 workers and selfemployed This term includes anyone who is contracting for a business or firm A key marker for independent contracting is the flexibility of work

Ready For The 1099 Nec Murray Roberts Otto Cpa Firm S C

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

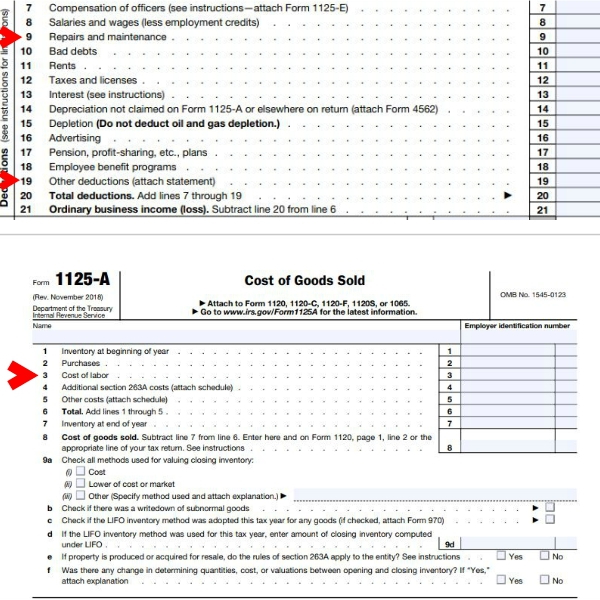

Tax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rateForm 1099 MISC IRS is the most common 1099 type that's sent to independent contractors and selfemployed from entities that pay over $600 during the tax year If these entities pay less, you still have to report your income through the tax report If you're a payer, you can fill 1099 MISC Form online free Tax Refunds & Unemployment Form 1099MISC is the most common type of 1099 form 1099MISC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly employed by the business entity or individual making the payment For example contractors It can also be used to report royalties, prizes, and award winnings

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

1099 Nec Available

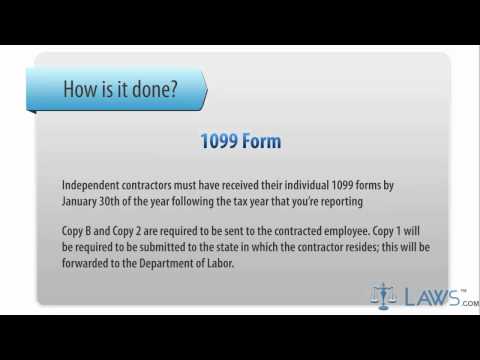

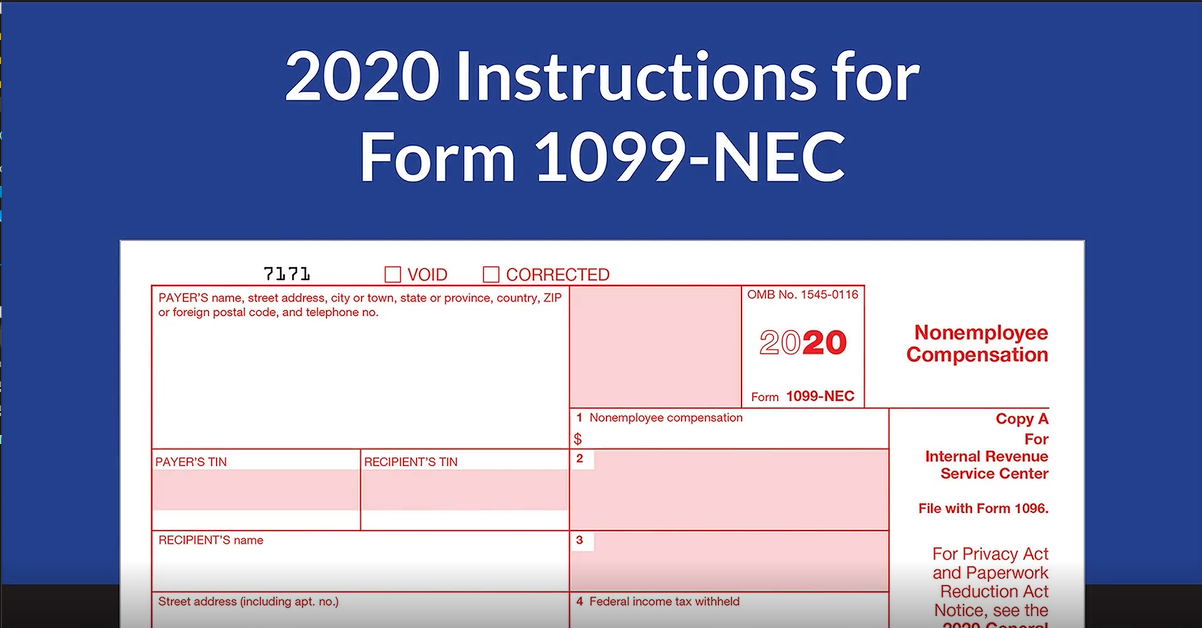

Printable 1099 Form – If you have done any freelance function or other independent contractor function, you might get a 1099 Form from companies that you simply have worked with more than the years (most probably a 1099MISC) 1099MISC Forms report back to the Internal Revenue Service, exactly just how much a business has paid for you previously year being an independent contractorForm 1099NEC 1099NEC forms are tax forms used by employers to report payments that they make to independent contractors and freelancers Contractors need 1099NEC forms so that they can accurately report their income and pay any taxes due by April 15th of each year The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)

Prepare To Issue New Irs Form 1099 Nec By Jan 31 21 Ohio Cpa Firm Rea Cpa

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Printable 1099 NEC Tax Form Overview In this tax session millions of independent workers will receive 1099 NEC Tax Form in the mail for the first time 1099 NEC Tax Form is the new Form to report nonemployee compensation that includes payments made for independent contractor jobs, freelancers, etc Previously, businesses reported income paid to nonemployees on Form 1099 1099 Form Independent Contractor By Adeline Hubbard 0 Comment While the income of workers is reported on Form W2 by their employer, independent contractors will collect Forms 1099MISC to report income to the IRS It is a common exchange between independent contractors and their customers Simply put, the 1099 Form is utilized for registering and reporting selfemployed income to the IRS, along with such types of income as government payments, rent payments, various kinds of awards, as well as other forms of outsideemployment revenue Make sure you browse through the 1099 form instructions below and complete the form on time

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

1099 Form 19 Due Date

The tax form 1099 in is issued to report income from independent contractors If you have a form 1099 blank template than you can use it for your own tax return There are different forms 1099 which you can print from pdf or docx and use it for your personal informationPrintable 1099 Form – A 1099 is a form that reports specific kinds of income tax payers have earned during the year It's important because it's used to track the income that is earned outside of employment by the taxpayer A 1099 could be issued for cash dividends that are received to buy stock, or to record interest income from an account in a bankA list of job recommendations for the search printable 1099 forms independent contractorsis provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Form 1099 Nec Instructions And Tax Reporting Guide

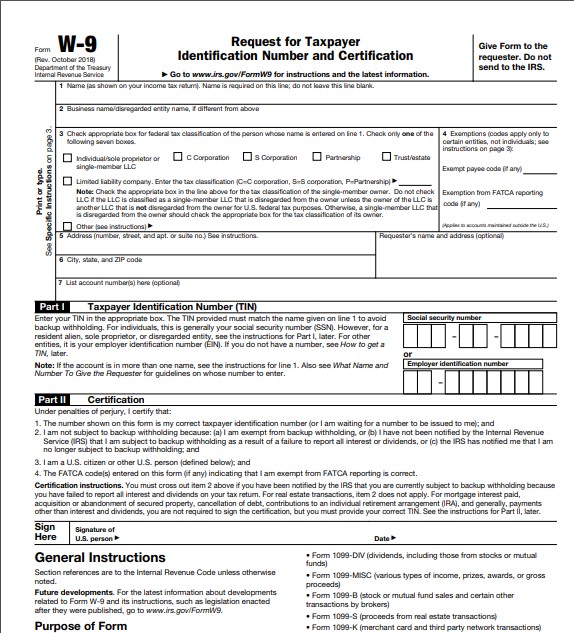

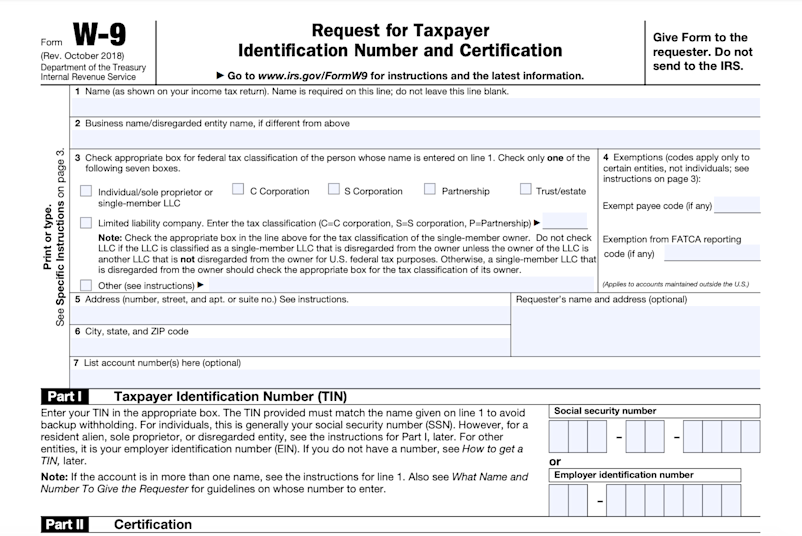

Inst 1099G Instructions for Form 1099G, Certain Government Payments 21 Inst 1099G Instructions for Form 1099G, Certain Government Payments Form 1099H Health Coverage Tax Credit (HCTC) Advance Payments 12 Workers operating as independent contractors need to provide their own benefits and cover their expenses For tax purposes, the key thing to understand is the form that you receive If you are paid as an independent contractor, you will receive a Form 1099MISC, while if you are paid as an employee, you will receive a W2 formOnce you start, use the HELP tab for 1099MISC tips and explanations Ok, Start 1099MISC Now

Irs W9 Form 21 Printable W9 Form 21 Printable

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

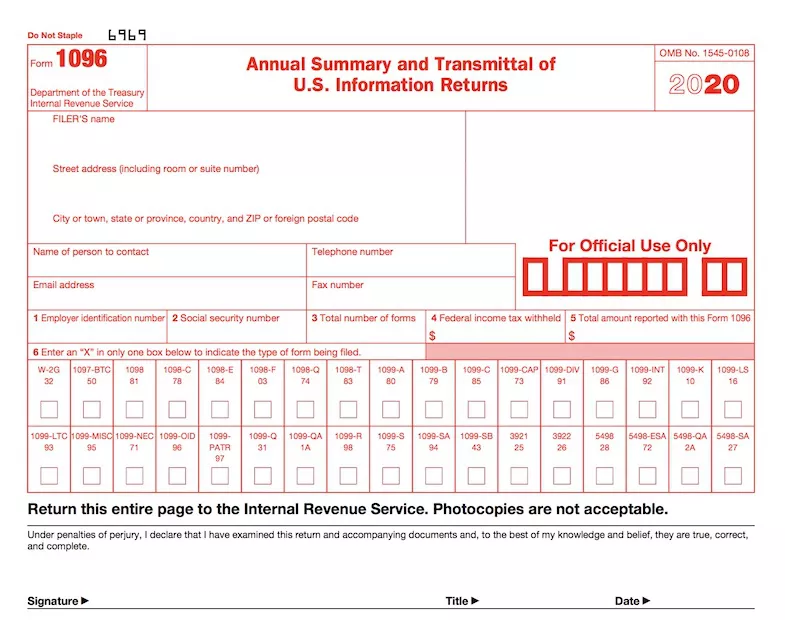

Irs Form 1096 What Is It

Form 0022 SHARE ON Twitter Facebook Google 21 Posts Related to Printable 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors Printable 1099 Form Independent Contractor Free Printable Estimate Forms Contractors 9 photos of the "1099 Form Template" Irs 1099 Form 19 And 1096 Form 19 Printable 1099 Form And File 1099 Online 1099 Form Download And Form 1099 Instructions Printable 1099 Form 19 And 1099 Int Form 19 1099 Form Independent Contractor And W9 Vs 1099 19 Form 1099 Misc And Miscellaneous IncomeForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade The independent contractors

How To File 1099 Misc For Independent Contractor

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

By Madelene Mathieu 21 Posts Related to Miscellaneous 1099 Form Independent Contractor Printable 1099 Form Independent Contractor Printable Independent Contractor 1099 Form 1099 Miscellaneous Form 1099 Miscellaneous Form 17 1099 Miscellaneous Form 16 1099 Miscellaneous Form 18

Form 1099 Misc Bhcb Pc

1099 Misc Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Get W 2 Forms And 1099 Misc Forms

W 9 Form Fill Out The Irs W 9 Form Online For 19 Smallpdf

1099 Form 18 Fill Out And Sign Printable Pdf Template Signnow

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Irs Form 1099 Fill Out And Sign Printable Pdf Template Signnow

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

21 Irs Form 1099 Simple Instructions Pdf Download

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

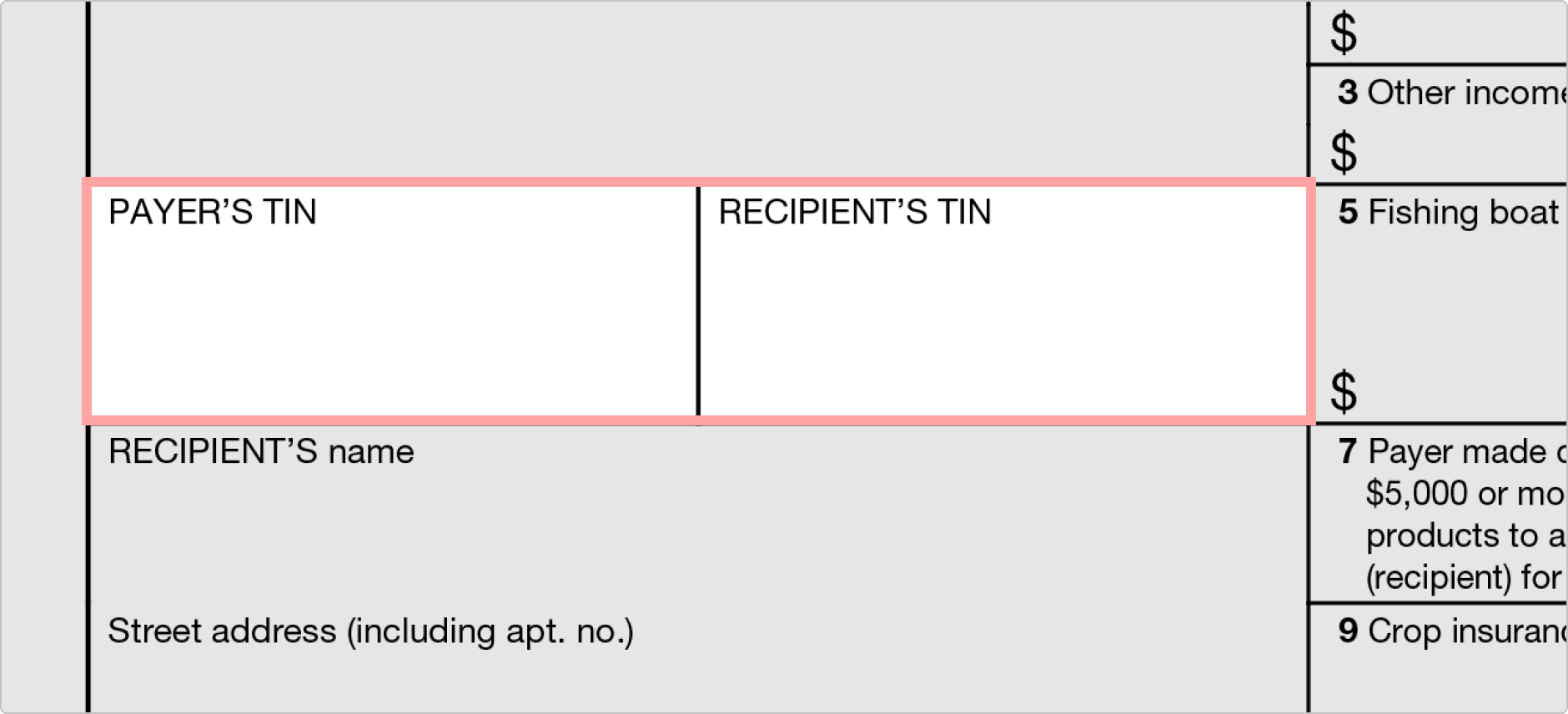

What Is The Account Number On A 1099 Misc Form Workful

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

W9 Tax Forms 21 Printable Payroll Calendar

W 2 Form Printable Get Tax Form W2 To Print Blank Template In Pdf Fill Online

1099 Misc Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

W9 Form 21 Printable Payroll Calendar

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Form 19 For Independent Contractors

Form 1099 Nec What Does It Mean For Your Business

1099 Misc Form Fillable Printable Download Free Instructions

Irs Instruction 1099 Misc 21 Fill And Sign Printable Template Online Us Legal Forms

Amazon Com 1099 Misc Forms 21 4 Part Tax Forms Kit 25 Vendor Kit Of Laser Forms Compatible With Quickbooks And Accounting Software 25 Self Seal Envelopes Included Office Products

Do You Have Independent Contractors Working For You Are You Keeping Track Of The Payments Made To Them Independent Contractor Work On Yourself Printables

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

W9 Form 21 Printable Blank

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

1099 Form 19 Pdf Fillable

1099 Misc Form Fillable Printable Download Free Instructions

Klauuuudia 1099 Misc Template

Excel1099 How To File Form 1099 Nec With Excel Youtube

1

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Tax Form 1099 Misc Free 1099 Form Filing 1099 R By Form1099 Issuu

Independent Contractor Application Pdf 21 Fill And Sign Printable Template Online Us Legal Forms

1099 Form Fill Out And Sign Printable Pdf Template Signnow

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Irs 1099 Misc Form Online Filing Instructions By Form1099online Com Authorized Irs E File Provider Medium

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

W 9 Form Fillable Printable Download Free Instructions

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Fill Out A 1099 Misc Form Thepaystubs

1099 Form 19 Pdf Fillable

Instant W2 Form Generator Create W2 Easily Form Pros

2

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

Form 1099 Requirements

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec Form Pros

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Fillable Form 1099 Misc 21 Printable Form 1099 Misc 21 Blank Sign Forms Online Pdfliner

Irs Form 1099 Reporting For Small Business Owners In

Where To Report Payment Made To Independent Contractors On Form 11 S Nina S Soap

Instant Form 1099 Generator Create 1099 Easily Form Pros

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

1099 Form 19 Online Tax Form 1099 Irs All Extensions To Print With Instructions

1099 Software 1099 Printing Software 1099 Efile Software And 1099 Forms Software

Irs 1099 K 21 Fill And Sign Printable Template Online Us Legal Forms

1099 Misc Form Fillable Printable Download Free Instructions

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Irs Form 1099 Reporting For Small Business Owners In

Form 1099 Nec Instructions And Tax Reporting Guide

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Forms Printable 1099 Forms 21 22 Blank 1099

Form 1096 A Simple Guide Bench Accounting

How To File 1099 Misc For Independent Contractor

1099 Misc Form Fillable Printable Download Free Instructions

1099 Form 19 Pdf Fillable

Form 1099 Misc 18 Credit Card Services Form Electronic Forms

3

Fill Free Fillable Irs Pdf Forms

1

Form 1099 Nec Is New For Here S What You Need To Know

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

0 件のコメント:

コメントを投稿